Our track record is only as strong as the performance of the individual assets acquired for our four funds — three of which are closed to new investments. Our most recent fund, SCI Growth & Income Fund 4, opened in Q4 of 2023 and already holds the highest quality and highest valued assets in our history.

The Bourse Parking Facility

Off-Market Acquisition | Q2 2025

Fully stabilized with a strong in-place operator, clean financials, and no deferred maintenance. And $3.2 million in annualized revenue

Philadephia, PA

In Q2 2025, we acquired a multi-level structured parking garage in the heart of historic downtown Philadelphia—just blocks from Independence Hall, the Liberty Bell, and the National Constitution Center. This off-market acquisition is a prime example of the Fund 4 thesis in action: immediate income, built-in equity, and durable demand in a no-new-supply market.

The property generates over $3.2 million in annualized revenue and offers a 12.7% Day One Return on Equity—all without the need for heavy renovations or repositioning. With tourism, business travel, and civic events consistently drawing traffic to this corridor, this facility offers exceptional income resilience and pricing power.

At the time of acquisition, the asset was fully stabilized with a strong in-place operator, clean financials, and no deferred maintenance. With structured parking development in this part of the city now functionally impossible due to zoning overlays and preservation restrictions, the facility’s location gives it an irreplaceable edge in the long-term value equation.

The garage was acquired off-market at a 5.3% discount to appraisal, securing $1.35M in built-in equity on Day One.

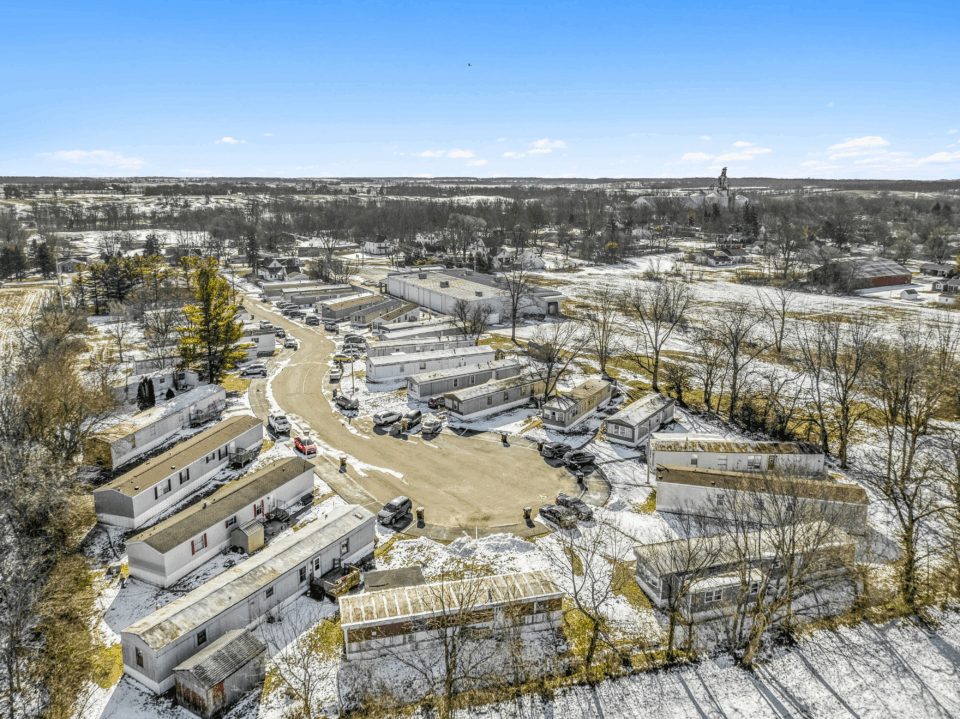

Darby View MHP

Off-Market Acquisition | Q2 2025

Stable cash flow from day one, built-in equity at close, and long-term value through efficient operations

Columbus, Ohio

Darby View is a fully resident-owned mobile home park, meaning there are no park-owned homes on site. This structure dramatically reduces maintenance overhead and turnover risk while promoting long-term tenant stability. At the time of closing, the community was 100% occupied and fully stabilized.

In Q2 2025, we acquired this 30-pad mobile home community located in Columbus, Ohio. This off-market acquisition reflects the core strengths of our Fund 4 strategy: stable cash flow from day one, built-in equity at close, and long-term value through efficient operations.

Backed by fixed-rate financing and a resident-owned model, Darby View offers immediate income with minimal capital expenditure needs. And with demand for affordable housing in Columbus continuing to rise, we see strong long-term potential for cash yield and equity growth.

Charlotte Parking Facility

Off-Market Acquisition | December 2024

Walking distance to Charlotte’s Spectrum Center, Bank of America Stadium, and Truist Field

Charlotte, NC

The Charlotte Parking Facility is a seven-story, institutional-grade asset located directly across from the Spectrum Center, home of the Charlotte Hornets. This premier location places it at the heart of one of the fastest-growing cities in the U.S., ensuring steady demand from event-goers, office workers, and downtown visitors. Acquired in an off-market, direct-to-owner transaction, this asset represents a prime example of our ability to secure high-quality investments at a discount in a constrained market.

In real estate, location is everything—and this property is as good as it gets. Situated within walking distance of the Spectrum Center, Bank of America Stadium, Truist Field, and Charlotte’s booming central business district, this parking facility benefits from year-round demand drivers. The property sits amid some of Charlotte’s most sought-after hotels, office towers, and high-end residential developments, creating a diverse and resilient customer base.

American Presidential Estates

Off-Market Acquisition| December 2024

503 institutional-grade sites added to our growing Midwest portfolio

Wayne County, MI

This off-market transaction presents an exceptional opportunity to tap into immediate value through rental optimization and operational efficiencies. With our proven value-add strategy, we are positioned to enhance both investor returns and the long-term viability of these communities.

Strategically located just hours from our existing holdings in Fort Wayne, IN, and Columbus, OH, these communities strengthen our footprint in a prime Midwest corridor.The market fundamentals further reinforce the strength of this investment. Ann Arbor’s housing market continues to expand, with an average home price of $456K (+6% YoY) and median three-bedroom rents of $2,900 per month—28% above the national median. This demand is driven by a robust local economy anchored by the University of Michigan, major healthcare systems, and a rapidly expanding tech sector, creating long-term stability for quality affordable housing.

Ridgebrook Hills MHP

Off-Market Acquisition | December 2023

$5.4M in instant equity

Fort Wayne, IN

The Ridgebrook Hills mobile home community in Fort Wayne, Indiana, stands out as a prime investment for several compelling reasons. Upon acquisition, Sunrise Capital Investors (SCI) created an impressive $5.4 million in instant equity, translating to an immediate 20% return on equity for investors. This significant financial uplift showcases SCI’s ability to identify and capitalize on undervalued assets, ensuring immediate value creation.

Positioned in Indiana’s second-largest city, Ridgebrook Hills is an institutional-grade property that benefits from being in a highly desirable and expanding housing market. As the largest community in the area with 738 spaces, it meets a substantial demand for affordable housing, evidenced by the near 90% occupancy rates in the region (what’s more, the park itself boasts ~95% occupancy). The economic dynamism of Fort Wayne, fueled by diverse industries and significant corporate investments, further bolsters the investment’s appeal. The combination of strategic location, high current occupancy, and potential for rent and amenity enhancements, along with the substantial instant equity generated by SCI, makes Ridgebrook Hills a particularly attractive opportunity for robust and sustained investor returns for years to come.

Central NC MHP Portfolio

Off-Market Acquisition | August 2024

Fund 4 Acquisition

A 50%+ chunk of instant equity

Greater Greensboro, NC

Our latest acquisition in the North Central NC MSA provides a nice 50%+ chunk of instant equity and a significant return for our Fund 4 investors. This acquisition exemplifies our strategy of targeting undervalued assets to generate substantial value for our investors.

This Greensboro-area MHP is a unique asset in our portfolio, featuring expansive single-family style lots, wide roads, and rolling meadows. This is the last institutional-sized mobile home community in this rapidly-growing North Carolina metro. It offers a perfect blend of affordability and desirability, attracting individuals looking to downsize in this thriving city.

We acquired this Central NC MHP for $3.7 million, with a current appraised value of $5.6 million. This acquisition adds to the cumulative sweat equity in Fund 4. With planned improvements, we project the park’s value to increase substantially. Our approach includes increasing rents to just below market rates and utilizing the fully modern infrastructure to maximize occupancy and revenue.

Lakeridge Estates MHP

Off-Market Acquisition | March 2024

Fund 4 Acquisition

A resort-style park on a lake

Huntsville, OH

Our latest venture in Central Ohio, the Lakeridge mobile home community is delivering an immediate $1.5 million in instant equity, equivalent to an impressive 29% return on equity to Fund 4 investors from the outset. This exceptional opportunity underscores our commitment to identifying and capitalizing on undervalued assets to generate immediate value for our investors.

Our strategy for Lake Ridge includes a light value-add approach, focusing on two main areas: recapturing lost lease by adjusting below-market rents to current rates, and improving operational efficiencies, such as implementing utility billing. These steps are anticipated to significantly increase the community’s value without relying on the more challenging infill process. We aim to implement reasonable 5% rent increases, yearly – to boost your bottom line and ensure residents are happy.

Additionally, we’ve secured a favorable loan with a 3.3% interest rate for the next eight years, enhancing the deal’s attractiveness by ensuring strong cash flow. This loan, combined with our planned improvements, positions Lake Ridge as a highly lucrative investment, promising both immediate returns and long-term growth.

Miami Village MHP

Off-Market Acquisition | June 2024

Fund 4 Acquisition

An all-ages, affordable 94 spaces community in Fort Wayne, Indiana

Fort Wayne, IN

Like the lion’s share of our deals, Miami Village was acquired through a direct-to-owner transaction, facilitated by our extensive local network. With over 700 units already owned in the Fort Wayne MSA, we were able to significantly leverage existing relationships to purchase this deal in full alignment with our immediate equity, implementing value-add improvements, and achieving substantial returns.

At acquisition, Miami Village faces several challenges. The lot rents are 32% below market, and operational inefficiencies need to be addressed. Additionally, the property requires aesthetic and infrastructure improvements to maximize its potential.By maintaining a focus on operational excellence and leveraging our extensive market knowledge, Sunrise Capital Investors aims to achieve exceptional results, even without the use of financial engineering. We bought this one with a 40% return on equity, day one – we’re only going up from here. Once we implement the “improve” and “refinance” elements of our strategy, we expect investor cash flow and growth for decades to come.

Elk Creek Mobile Home Park

Off-Market Acquisition | August 2024

Fund 4 Acquisition

An immediate $2.5 million in instant equity

Madisonville, KY

Elk Creek Mobile Home Park is institutional-gem in Madisonville, Kentucky, set to deliver an immediate $2.5 million in instant equity, equivalent to a remarkable 25% return on equity for Fund 4 investors right from the start. This acquisition highlights our continued focus on uncovering undervalued assets and transforming them into high-performing investments for our investors.

Our strategy for Elk Creek includes a light value-add approach, aimed at maximizing returns without extensive overhauls. We plan to recapture lost income by adjusting rents, which are currently below market, and by addressing operational inefficiencies—most notably, canceling a $100K annual cable bill. This move alone will immediately boost the park’s NOI, adding 100% of the savings directly to the bottom line. Additionally, the park’s legacy owner, who has over 30 years of experience, is scaling down operations, offering us the chance to step in and modernize management while enhancing tenant satisfaction.

In addition to the instant equity, the property’s location in the best school district in the market, coupled with its proximity to top employers and major retailers, positions it as a highly attractive option for long-term residents. The majority of homes are tenant-owned, which contributes to a stable and “sticky” tenant base, reducing turnover and ensuring steady occupancy.

Previous Funds’ Assets Case Studies

Luhrs Parking Garage

Date Acquired | May 2023

This Legendary Property in Phoenix Is A Pro Sports Fan’s Dream…

Phoenix, AZ

Luhrs Parking Garage is institutional grade, Class A property located within a 3-minute walk from the Phoenix Suns and Arizona Diamondbacks stadiums. Sunrise negotiated and purchased a high-quality, stabilized asset, at well-below replacement cost, in one of the hottest markets in the nation.

We intend to buy, improve, and hold the Luhrs Parking Garage for decades to come. After optimizing rates and improving operational efficiency, we expect to significantly increase the NOI and overall value of the property. It’s a historical, generational asset in Downtown Phoenix that will provide stable, recurring income for many years into the future. This visibility of income provides safe, predictable cash flow (and clarity) for our Fund 3 partners.

North Beach Parking Plaza

Date Acquired | May 2022

A High Performing Class A Parking Facility On America’s No.1 Beach

Clearwater Beach, FL

This off-market acquisition is an institutional grade, Class A property where visitors park to enjoy the #1 beach in the country. With lack of parking supply and massive demand, the City built North Beach Parking Plaza brand new in 2017. It’s a generational asset on Clearwater Beach with a long-term lease that provides stable, recurring income for many years into the future. This visibility of income over the next decade provides safe, predictable cash flow (and clarity) for our Fund 3 partners.

Park Estates MHP

Date Acquired | Dec 2021

On Day One, We Realized An Incredible 30% Return…

Twin Cities, MN

With no broker involved, this mobile home park is a true off-market deal being purchased from a long-time, legacy owner who has overseen the asset for over 40 years. Currently charging 32% below market rent, this property epitomizes our traditional light value-add transaction, Based on the appraisal of $10.82mm, we are able to achieve a 30% return on equity on day one.

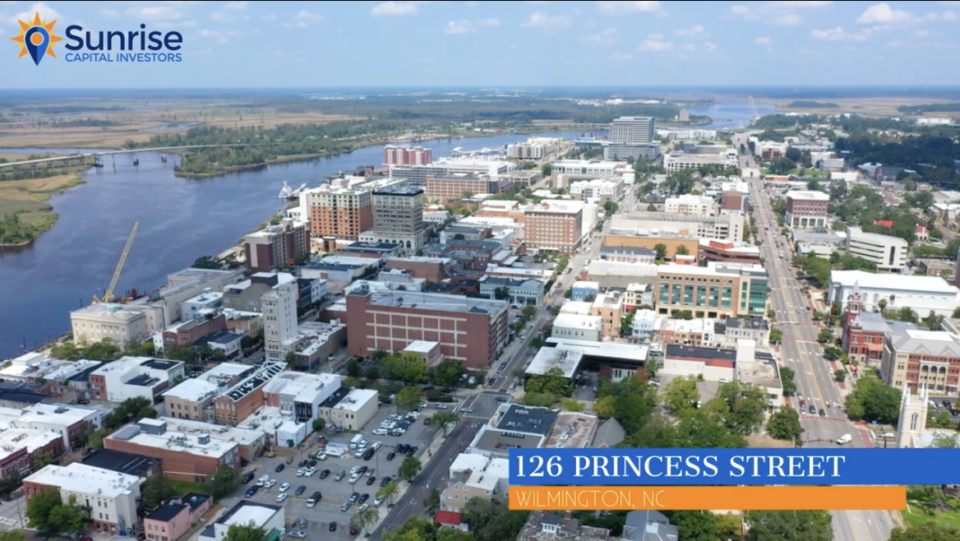

Princess St Parking Lot

Date Acquired | Oct 2020

An exceptional location on a hard signalized corner in a growing market

Wilmington, NC

Sunrise negotiated a $695k purchase price, which pencils out to a 9.3 capitalization rate at acquisition. Based on the purchase appraisal of $1mm, we were able to achieve a 43% return on equity on day one. Our long-term lease provides stable, recurring income for many years into the future. This visibility of income over the next decade provides safe, predictable cash flow (and clarity) for our Fund 3 partners.

Ridgeview MHP

Date Acquired | Dec 2018

When We Sell – We Create Massive Equity First. Here’s What We Do Next..

Lockport, NY

Sunrise negotiated a $3.77mm purchase price and began working to improve the community. Capital was infused to fix water leaks and make necessary road repairs.

Prior to sweeping rent control being enacted in NY, Sunrise recaptured a portion of the loss-to-lease. Over three years, lot rents moved to $370. With physical occupancy abutting 100% and strict rent control in place, Sunrise maximized the value of the asset and decided to sell the property. All told, Sunrise created over $1mm of sweat equity in three years.

Huron Estates MHP

Date Acquired | July 2018

A 126% Property Value Increase in 3 Short Years

Cheboygan, MI

Sunrise received a tip from a podcast listener about a community bank that was interested in selling a non-performing MHP note. Sunrise purchased the note for less than $1mm and began renovations, repairing damaged roads, rectifying deferred maintenance, replacing on-site management, stabilizing poor collections, and installing water meters to promote conservation.

Sunrise increased the NOI, boosting revenue and lowering the expense ratio to 48%. Within three years, the property value increased by 126%. Having created significant sweat equity, Sunrise decided to sell the asset for $2.25mm, providing investors with an exceptional risk-adjusted return.

Akron MHP

Date Acquired | Nov 2017

We Increased Lot Rents from $315 to $425. Here’s What Happened Next…

Akron, NY

Sunrise negotiated a $1.4mm purchase price and began the turnaround by power washing all homes, repaving the roads, replacing the leach field, and installing water meters to promote conservation. With a significantly improved quality of life, residents were happy to increase their lot rents from $315 to $425 over a three year period, demonstrated by an increase in both physical and economic occupancy.

Sunrise maximized the value of the asset, and ultimately disposed of the asset for $2.3mm in August 2020. We created nearly $1mm of sweat equity in three years.

Cedarhurst & Walston MHP

Date Acquired | Oct 2017

We QUADRUPLED This Park’s Value in A Few Short Years…

Salisbury, MD

Sunrise negotiated a combined $2.6mm purchase price for the properties. Upon acquisition, Sunrise replaced on-site management, pumped septic tanks, demolished unsalvageable abandoned homes, renovated salvageable park-owned-homes, and power washed units. Once aesthetics improved, Sunrise set about recapturing the loss-to-lease.

Sunrise has created over $3.5mm in sweat equity on an original investment of $1.1mm. By 2022, the real estate was worth well over $10mm, more than quadruple the value at acquisition.

Orange City MHP

Date Acquired | July 2017

We Generated A Million in Equity in 3 Short Years with this Florida Park

Orange City, FL

Sunrise negotiated a $1.4mm purchase price and began the turnaround by power washing all homes, repaving the roads, replacing the leach field, and installing water meters to promote conservation. With a significantly improved quality of life, residents were happy to increase their lot rents from $315 to $425 over a three year period, demonstrated by an increase in both physical and economic occupancy.

Sunrise maximized the value of the asset, and ultimately disposed of the asset for $2.3mm in August 2020. We created nearly $1mm of sweat equity in three years.

Blackburn MHP

Date Acquired | Oct 2016

Our Investors Grabbed A 40%+ Return with this Alabama Mobile Home Park

Athens, AL

Sunrise negotiated a $700,000 purchase price and favorable seller-financing with a 25% down payment. Upon acquisition, Sunrise replaced on-site management, power washed all mobile homes, added skirting and shutters to all homes, pumped all septic tanks, and increased curb appeal with improved landscaping.

Once cosmetics improved, Sunrise brought in ten new mobile homes and used lease-option transactions to increase economic occupancy.

Shady Grove Mobile Home Park

Date Acquired | Nov 2015

Immediate Upside with This Virginia Mobile Home Park

Petersburg, VA

Sunrise negotiated a $650,000 purchase price, and the previous owner carried financing with the following terms: 25% down payment, 7% interest, with 25-year amortization. We felt confident in our ability to increase NOI to $120,000 shortly after acquisition by instituting more professional property management.

Upon acquisition, we put proper leasing practices in place, instituted a large scale marketing effort, scrutinized repair & maintenance, cut payroll, and trimmed unnecessary expenses.

Green Level MHP

Date Acquired | Nov 2014

We Doubled the NOI to create an INFINITE Cash-on-Cash Return

Burlington, NC

Green Level MHP was identified through our internal marketing efforts. Green Level was sourced via cold call, and our lead principal Kevin Bupp began negotiations to purchase the property in a direct-to-owner transaction.

When Sunrise took over the property, the park had numerous infrastructure problems, inferior on-site management, below market rents and poor collections. Sunrise doubled the property’s NOI within the first three years of ownership and returned all investor capital along the way.

Country Oaks MHP

Date Acquired | Dec 2012

100% Vacant to 100% Occupied…

Lovejoy, GA

Sunrise negotiated a $200k purchase price and began the top-to-bottom renovation. We brought in a qualified onsite manager to establish law and order. Within twelve months, every home in the community had undergone a complete renovation and the park transformed from 100% vacant to 100% occupied.

Sunrise subsequently executed a cash-out refinance on the property, returning all investor capital in the process. Investors now have an infinite cash-on-cash return while retaining equity in a $1.3mm asset.